Impervious to Crisis: Consistent Growth of Digital Advertising Networks in the World

It may be too early to discuss the results of 2014 but the key indicators are pointing to accelerated growth for DOOH media by year’s end. If 2013 for digital networks ended with relatively good growth rate of 8.4% (according to PQ Media, professional agency that offers analysis of the world media market since 2003), the key indices for the first half of 2014 are so positive that allow analysts to forecast the continued growth of 11% for the whole of 2014.

In spite of the relatively depressive economic situation in the world when the majority of the developed countries are happy to score 2% economic growth, and the emerging markets consider small negative indices a measure of success, the digital advertising market is growing consistently for the second year running push forward by growing advertising spending for sport and transport. The other sectors that contributed to the growth of the outdoor advertising are the cinemas, healthcare establishments and entertainment arenas.

|

|

| The world’s largest advertising digital billboard at Times Square | Digital billboard by XTD Ltd. in Melbourne metro |

It seems that the digital advertising sector is not affected by debt issues, asset bubbles, political tensions and slower economic growth. Digital out-of-home (DOOH) media operators defied the economic and political headwinds worldwide grinding out a revenue gain to USD 8.86 billion in 2013, numbers comparable with the GDP of a small country. The US remained the world’s largest DOOH market, with nearly USD 2.5 billion in revenues, followed by China with revenues slightly under USD 2 billion.

The important sport mega-events helped digital advertising growth in Russia (Youth Universiade in 2013, winter Olympic Games in Sochi in 2014). At the same time the analysts point out an important parameter of the increasing consumer exposure to DOOH. It rose to 14 minutes a week in 2014. This is the average time each of us spends looking at digital advertising when we are not at home. What is important is that the exposure time is consistently growing at approximately 7.2% in both 2012 and 2013.

This means that we are gradually getting used to digital advertising outdoor, start paying more attention to it. These are the important indices that convince DOOH operators, advertisers and large media agencies to expand the networks, to increase advertising budgets, to redistribute the budgets in favour of digital advertising.

|

|

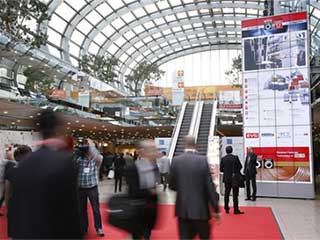

| The world's largest video wall in Messe Düsseldorf | Ocean Outdoor’s latest digital billboard iconic location |

Asia-Pacific was the largest of the four global regions in 2013, with aggregate revenues over USD 3.83 billion, fueled by surging growth in Australia and a strong rebound in Japan. The injection of ad spending and new deployments ahead of the World Cup helped Brazil’s DOOH industry grow at the fastest rate, rocketing to more than 40%.

In general, analytic agencies’ forecast defines DOOH media by two major platforms, digital place-based networks (DPN) and digital billboards (DBB) and signage. Slow-moving economies weighed on cinema, the largest digital place-based network vertical, resulting in several global markets to post revenue declines. Although global revenue is on pace for faster growth in 2014, several challenges continue to shadow digital place-based network operators, including issues related to standardized measurement, planning and buying systems, mobile media integration, and operator consolidation and its impact on network scale.

|

|

| Interactive digital signage in New York metro | Digital transit shelters in Toronto |

The rapid growth of mobile media started to counterbalance the quantitative growth of DOOH advertising. Digital place-based network operators are now convinced that driving consumer engagement through mobile interactivity will only become more important with each passing year. Some experts believe that mobile media revenues will be larger than the entire global DOOH industry by year-end 2014. Digital place-based networks are already being squeezed by mobile, with brands increasingly demanding mobile components to their integrated media campaigns.

In conditions when the effective advertising campaign requires the consolidated approach and integration of various advertising media, the small and medium operators find it difficult to survive. The clients demand unusual individual customized solutions that are nearly impossible for small players. The growing market competitiveness even resulted in the appearance of the new term “media inflation”.

The resulting tendency to merges and acquisitions affected almost all countries, including Russia. Here the development of outdoor advertising industry is determined by several factors: amendments to the law “On Advertising” adopted in 2012-2013, compiling of the list of allowed advertising structures (that miraculously “missed” all static billboards), renewal of contracts for outdoor advertising agencies, dismantling of illegal advertising structures, etc.

|

|

| Digital billboard and signage in Auckland airport | New digital billboard by MediaCo in Manchester |

Many local governments ruled to shut down digital boards to free cities from excessive advertising, to de-clutter big metropolis, such as Los Angeles and Moscow. Nevertheless, OOH operators continue to transition static signs to digital for the simple reason that digital signs generate higher revenues and margins.

Previously, market leaders owned approximately half of all outdoor media assets. But in 2013-2014 the tendency changed and their share rose to nearly 80%. In these difficult conditions of market restructuring the segment of digital boards continued to grow, primarily due to small digital signs and enormous media-façades. In Russia the digital outdoor revenues rose by modest 4% and in the USA by more attractive 11.5%.

This tendency is easy to explain: advertising digital boards are no longer marginal carriers and account for sizeable part of advertising budgets. Located near the transport hubs, sport arenas and large commercial complexes, digital billboards are becoming an indispensable part of brand advertising. It means that digital advertising remains an attractive investment segment in spite of market fluctuations and oil and gas price drops. The digital outdoor advertising will enter the coming 2015 with flying colors.